Estimate the present value of the tax benefits from depreciation

The alternative minimum tax AMT is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals estates and trustsAs of tax year 2018 the AMT raises about 52 billion or 04 of all federal income tax revenue affecting 01 of taxpayers mostly in the upper income ranges. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Tax Shield Formula Step By Step Calculation With Examples

If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2021 the amount increases to 10200.

. The accounting shows the credit as a liability exhibit 2. Participants platform contributions for the tax year. And state laws such as doing business statutes.

Depreciation refers to the decline in value of an asset. NW IR-6526 Washington DC 20224. Asset balance of 1 million less accumulated depreciation of 1422500 and no retirement liability.

One of the most important aspects of owning real estate in New York is making sure you stay abreast of the rules pertaining to capital gains taxes so that you can make the type of prudent investment decisions that will maximize your long term wealth potential. Expensing or the immediate write-off of RD costs is a valuable component of the current tax system. Enter basic building info and instantly receive the estimated tax savings.

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. We welcome your comments about this publication and suggestions for future editions. Try it for free.

It includes the value people get from the existence of a cultural good existence value or from others being able to benefit from a good or service in the present altruistic value or for. Generates immediate increase in cash flow through accelerated depreciation tax deductions. This is notional tax depreciation needed for value in use purposes only to calculate income tax charge.

When Commissioner can disallow deduction for tax loss 17510. Recoverable amount is the higher of an assets IAS 366. The above fringe benefits except for tax reimbursement and hazardous or hardship duty pay are sourced based on your principal place of work.

Get 247 customer support help when you place a homework help service order with us. A states power to impose a tax is derived from the US Constitution and may be limited by the Commerce Clause of the Constitution. The quick sale value QSV of an asset is an estimate of the price a seller could get for the asset in a situation where financial.

Form 4562 Depreciation and Amortization is used to list the basis and depreciation of assets for tax purposes. Sales are projected at 190 unit. Which one would you choose.

Net present value allows you to estimate the present value of a project based on expected future cash flows. The project will cost 1 750000 have a four-year life and have no salvage value. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. In year 10 our balance sheet carries the value of the building at 500000 ie the book value which is the original cost of 1 million minus 500000 accumulated depreciation 10 years. Several new tax incentives are described in IRM 4411676 Tax Incentives for Refining and Use of Renewable Fuel Incentives.

Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance government activities. The Due Process Clause of the Constitution. Higher amounts may indicate present or past property ownership not declared on the CIS.

Net book value of zero less the 422500 retirement liability whereas depreciation accounting results in a negativeand counter-intuitivenet asset balance exhibit 3. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200. For more information see section 1863-1b of the regulations.

What this Division is about Subdivision 175-A--Tax benefits from unused tax losses 1755. R. The business mileage rate for 2022 is 585 cents per mile.

In computing the tax on the operating income there are three choices that you can use - effective tax rate about 29 for the average US company in 2003 marginal tax rate 35-40 for most US companies and actual taxes paid. Depreciation is straight-line to zero. The TCJAs change to amortization in 2022 requiring firms to write off their business costs over time rather than immediately would raise the cost of investment discourage RD and reduce economic output.

OMB opted to keep the existing language because both definitions cite 31 USC. For example if you purchase a piece of equipment for 10000. Allocation based on fair market value of product at export terminal.

Activities that could subject a foreign entity to state tax. For example the schedule is used to report the foreign corporations intangible development costs and reasonably anticipated benefits share and the US. Federal statutes such as Public Law PL 86-272.

The amount of economic benefits is the recoverable amount as per IAS 36 terminology. Cash flows are based on the money that you expect to receive as income and that you expect to pay as expenses. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

61013 which provides the scope of the transfer of anything of value A commenter recommended further. Someone else obtains a tax benefit because of tax loss available to. You are considering a new product launch.

One commenter recommended specifically explaining transfer anything of value in the definitions of cooperative agreement and grant agreement. Only those answering yes to Form 5471 Schedule G question 7 are required to complete and file separate Schedule G-1. Income or capital gain injected into company because of available tax loss 17515.

IRC 45H 179B 179C 40A including a new Exhibit 4411-31 History of IRC 40A Biodiesel and Renewable Diesel Fuel Credit. Estimate the present value of cash flows resulting from major future improvements. However if the property is used predominantly in the United.

Net present value over 10 years and over the life of the property. Many people are surprised to learn that almost anything you own can be considered a capital asset by the IRS.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

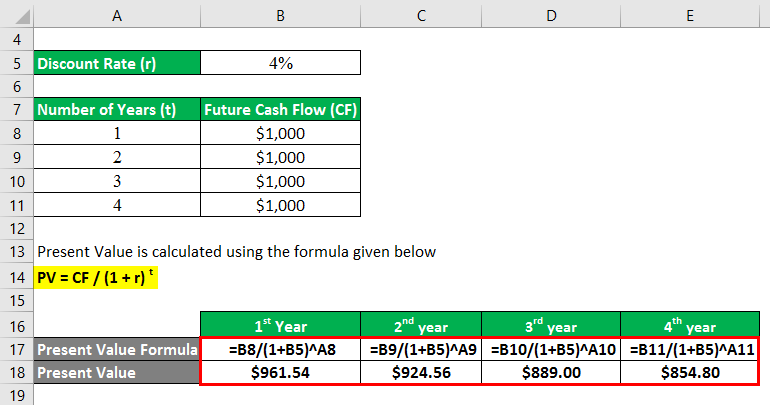

Present Value Formula Calculator Examples With Excel Template

What Is The Net Present Value Npv How Is It Calculated Project Management Info

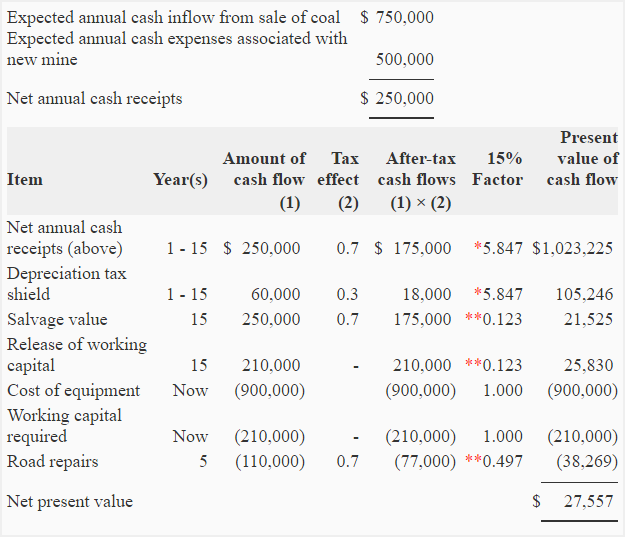

Problem 1 Net Present Value Method With Income Tax Accounting For Management

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Npv With Taxes Youtube

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Present Value Formula Calculator Examples With Excel Template

Adjusted Present Value Apv Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Chh1xbeol4bihm

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Npv And Taxes Double Entry Bookkeeping

Payback And Present Value Techniques Accountingcoach